All You Need To Know About Round Two Of Covid-Related Stimulus Checks

/https:/specials-images.forbesimg.com/imageserve/5f96dbbf802a3d7283dad549/0x0.jpg)

getty

Congress has finally agreed on a COVID relief package. It is the first significant stimulus action from Congress since the Coronavirus Aid, Relief, and Economic Security Act or the CARES Act was signed into law in March of 2020.

There hasn’t been a vote yet, but votes are expected today (December 21, 2020) in both Houses of Congress. If the bill passes, the President is expected to sign it into law.

As with anything tax-related, there’s a little bit of confusion. To help you sort it out, here are a few questions and answers about what the bill looks like as of now.:

When will I get my check? Checks are supposed to be produced quickly. Treasury Secretary Mnuchin indicated that, assuming the bill becomes law, checks would begin showing up in bank accounts as early as next week.

How big will my check be? Checks will be $600 per person – or $1,200 for married couples filing jointly – and an additional $600 per child.

What about limits on kids? There are no limits on the number of children that qualify. The definition of child will be the same as for the child tax credit.

Wait, does that mean that they did not put in a dependent fix? Yes, that’s exactly the case. For purposes of getting the $600 per child, the law uses the same definition for a child as you’d use for the child tax credit. The sticking point for most parents for this purpose was the age: the child must be under age 17 at the end of the tax year. With the first round of checks, that meant that taxpayers were not entitled to receive the $600 additional payment for a child above the age of 16, even if they lived with you, ate your food, spent your money and slept in your house. A change was included in earlier proposals to allow taxpayers with qualifying dependents (no matter their age) to receive checks, but that did not make it into the final bill. In other words, children over the age of 17 do not qualify as a dependent for purposes of stimulus checks.

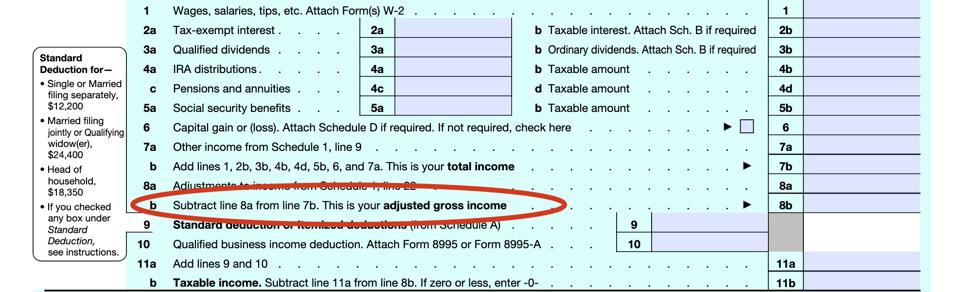

Are there income limits on checks? The amount of the checks would start to phaseout for those earning more than $75,000 ($150,000 for joint returns and $112,500 for heads of household). This is adjusted gross income (AGI), not taxable income – so before your standard or itemized deductions. You’ll see it on line 8b of your 2019 Form 1040:

2019 Form 1040 line 8b

Wait, how does a phaseout work? Phaseout means that the benefit goes down as income goes up. It’s a 5% drop which means that for every $100 of income above those thresholds, your check will drop by $5. So, if you are a single filer earning $75,100, your check will be $595 ($600-$5). If you are a single filer earning $85,000, your check will be $100 ($600-$500). If you do the quick math on that, it means that you’ll phaseout completely (meaning that you’ll get nothing) once you hit $87,000 as a single filer, $174,000 as a married couple filing jointly, or $124,500 for heads of household.

Does the phaseout apply to the dependent portion, too? Yes.

Why 2019? Just as in the CARES Act, it’s treated as an advance credit for 2020, but to get payments out quickly, the IRS will rely on 2019 tax returns.

What if I make less in 2020 than in 2019? Your check is determined by your 2020 income, but will be based on your 2019 tax returns. If you are entitled to more money, you can claim a credit on your 2020 federal income tax return for the difference (just as before).

Will I need a Social Security Number (SSN) to get a check? Yes. Or in the alternative, an adoption taxpayer identification number. Ditto for spouses and kids.

But I heard something about ITINs? Yes. You still need a valid SSN to get a check. However, if you are married to someone with an ITIN and you file jointly, this will not disqualify you from getting a check. Additionally, if you are a married taxpayer filing jointly and at least one of you has a valid SSN, you will receive a check for your dependent. This is different from the CARES Act.

What about decedents? After the fiasco of the last set of stimulus checks, Congress made a point to include language about decedents in this bill. Anyone who dies on or before January 1, 2020, is treated “as if the valid identification number of such person was not included on the return of tax for such taxable year.” That means no money for decedents – and if the decedent appears on a joint return, the amount is reduced accordingly.

So how does this work? Do I need to file anything to get my check? Just as before, the checks are advances of credits for 2020. It will not affect your “normal” refund in 2020, nor how much you owe – it’s the same as before. But since we haven’t filed for 2020 yet, the IRS will “advance” your check based on your 2019 tax return.

What if I didn’t file a 2019 tax return? Thankfully, this time the language is very specific in allowing non-filers who receive benefits from Social Security Administration, Railroad Retirement Board, and the Department of Veterans Affairs to receive automatic payments based on information already in the system. If you haven’t filed a tax return, and your income is from Social Security benefits, the bill allows Treasury to use the information on your 2019 Form SSA-1099, Social Security Benefit Statement, Form RRB-1099, Social Security Equivalent Benefit Statement. Treasury is otherwise empowered to use whatever means it deems efficient to get payments out so I expect to see another portal on IRS.gov.

How will I get my check? Direct deposit, if you’re lucky. The IRS will deposit your payment directly into the same banking account you used for direct deposit on your last filed return.

What if I’ve moved? Under the law, the Treasury must send notice of the payment by mail to your last known address. The notice will include how the payment was made and the amount of the payment. The notice will also include a phone number for the appropriate point of contact at the Internal Revenue Service (IRS) if you didn’t receive the payment. You can help make sure that it goes to the right place by updating your address after a move. Usually, you’d do that on your tax return, but you can also submit a federal form 8822, Change of Address (downloads as a PDF). It generally takes four to six weeks to process a change of address.

What if I am expecting a refund for the 2019 or 2020 tax year? Your 2019 or 2020 refund will not be affected by the stimulus check.

Is my check taxable? No. As before, this is not taxable income.

What if I’m currently receiving government benefits? Or I don’t have any income? You are eligible for a check even if you receive government benefits and even if you don’t have any income.

Will I still get the check if I owe the IRS some money? Yes. If your refund would normally be seized to pay a tax debt, that shouldn’t happen here. There are no offset provisions.

What if my check is normally seized for child support? Unlike the CARES Act, there is no offset for child support either.

Really, no seizures? There isn’t supposed to be. The bill says “no applicable payment shall be subject to execution, levy, attachment, garnishment, or other legal process, or the operation of any bankruptcy or insolvency law.”

But how will my creditors know to leave these payments alone? Under the CARES Act, once payments hit bank accounts, they could be subject to seizures and garnishment to satisfy existing liabilities. Now, payments are to be coded in an obvious manner so that banks would not allow payments to be seized to satisfy certain legal obligations.

This is a done deal, right? Not yet, we’re waiting on votes and signatures.

So no changes? I didn’t say that. This is, after all, 2020.

Not that I don’t trust you, but where can I find this in writing? It’s still a bill, not a law, but you can find the details in the House version here (downloads as PDF). But before you click, it’s over 5,000 pages long (yes, really). I’ll replace it with the enrolled version after the vote.

World News || Latest News || U.S. News

Help us to become independent in PANDEMIC COVID-19. Contribute to diligent Authors.

[charitable_donation_form campaign_id=57167]